Happy Friday, everyone! This article reminds us of all the potential problems that financial planning and investing mistakes can cause. We realize no one is perfect, but there are safeguards that can be instituted so you can feel confident in your retirement and estate planning decisions.

We can help. Just give us a call. And an added gift to you is our Osprey Estate Planning Organizer to download here! Print it out. Put one in your safe deposit box, give one to your executor or successor trustee, and make their job easier.

To your Prosperity!

Aaron Wade, Kasey Claytor, Dawn Lopez & Kelsey Bartholomew

A friend of ours was lamenting how slow and costly it was to sort out his parents’ estate after they had both passed away. His father thought that by setting up a trust, everything would be easily distributed to his heirs.

Unfortunately, our friend and his siblings found out that there were lots of loose ends their father hadn’t taken care of—things he wasn’t even aware he was supposed to do. For example, he had money in an investment account that wasn’t included in the trust and didn’t have named beneficiaries. As a result, his children were going to have to spend considerable time and money to send it through probate.

Our friend is convinced these were things that would all have been taken care of (or at least planned for) if his father had worked with a financial advisor. His dad was a highly intelligent man with good intentions. But what he didn’t know cost his kids thousands in unnecessary taxes and legal fees.

But it’s not just in estate planning where ignorance comes at a high cost.

Laura Beck writes in Yahoo!Finance about her conversation with a retiree who didn’t use an advisor, but now sees significant ways professional help could have greatly impacted his finances. She identifies him only as Wes B. (probably to save embarrassment).

One area where Wes B. realized he should have worked with an advisor was in saving for retirement. He thought he was being smart by putting money only in investments he understood, like the stock of the company he worked for. Now he realizes that his misunderstanding of risk led him to put too many eggs in one basket.

Another area Wes now wishes he’d had help in was timing when to take Social Security. He thought it was a no-brainer to start getting the benefit as soon as he was eligible at age 62. He made this decision, in part, because of his mistaken assumptions about his own predicted longevity. Now he sees it as a costly mistake.

But the biggest way Wes B. is now convinced an advisor could have helped him was in planning for unexpectedly big costs in retirement, such as healthcare and taxes. He thought Medicare would cover everything and that retirees didn’t have to pay taxes.

He told Beck that he made costly mistakes in all these areas—mistakes he could have avoided if he had sat down with an advisor.

Our friend with the challenging estate process put it this way: “An advisor’s job isn’t to help you ‘game’ the market for an extra thousand bucks. They’re there to keep you from making that $50,000 mistake.”1

And as our friend can attest, those mistakes are easy to make.

Your trusted advisor is there to help make sure your journey from wealth accumulation to retirement to passing along your estate goes according to a carefully considered plan. Taking steps today to prepare and plan with a competent professional can help both you and your loved ones achieve the financial wellbeing you desire.

Sources:

1. https://finance.yahoo.com/news/m-retired-boomer-7-reasons-120052274.html

Disclosure:

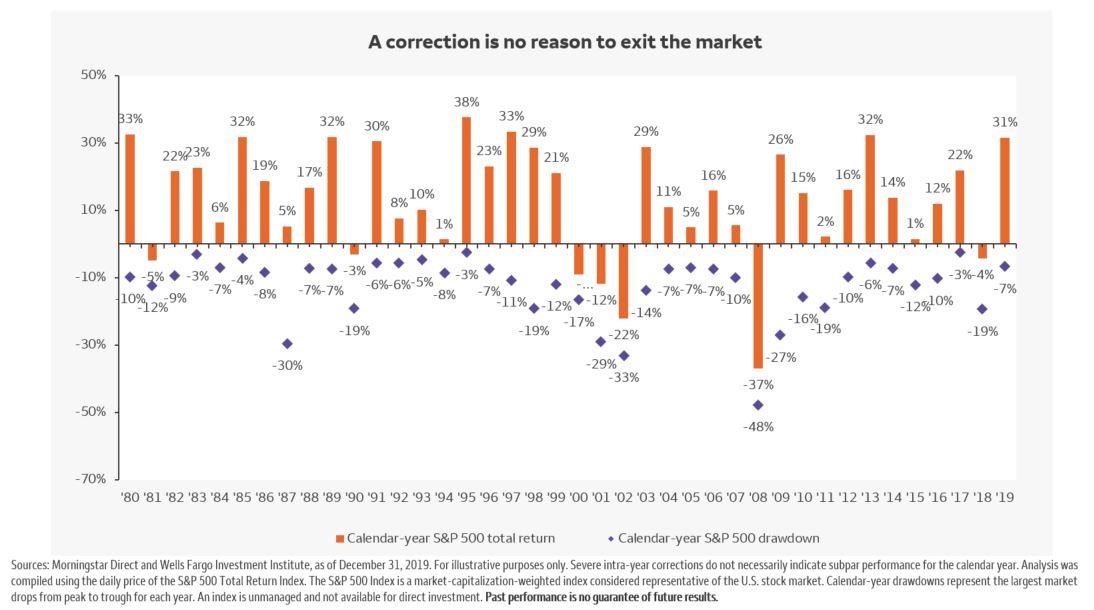

The views expressed herein are exclusively those of Efficient Advisors, LLC (‘EA’), and are not meant as investment advice and are subject to change. All charts and graphs are presented for informational and analytical purposes only. No chart or graph is intended to be used as a guide to investing. EA portfolios may contain specific securities that have been mentioned herein. EA makes no claim as to the suitability of these securities. Past performance is not a guarantee of future performance. Information contained herein is derived from sources we believe to be reliable, however, we do not represent that this information is complete or accurate and it should not be relied upon as such. All opinions expressed herein are subject to change without notice. This information is prepared for general information only. It does not have regard to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. You should seek financial advice regarding the appropriateness of investing in any security or investment strategy discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. You should note that security values may fluctuate and that each security’s price or value may rise or fall. Accordingly, investors may receive back less than originally invested. Investing in any security involves certain systematic risks including, but not limited to, market risk, interest-rate risk, inflation risk, and event risk. These risks are in addition to any unsystematic risks associated with particular investment styles or strategies.