Life throws us small and large challenges. That is true whatever your background is, wherever you live, or who you are born to. One of the main tests in life is how you react to it.

All this recent news has me wishing I could just sell my children’s book and live in that world. But that wouldn’t be fair to all of our dear and valued clients who expect to hear from us during bad times as well as good times. As you should.

So, the stock market is appearing to fall into the basement. Where is the bottom? When will it stop? Will we lose our assets? And when will this virus recede? What will happen before it does?

No one knows the answers to these questions. The biggest clue to the future we have is found by looking at what went before.We have been here many times! Since I began my career in this financial industry in 1983, I’ve seen this type of situation many times: epidemics, pandemics, bear markets, and market corrections. And this is true: they are temporary. The markets recover. The viruses go away.

What is different is the modes of communication. The wide spread use of social media, the insidious use of news media continuously ramping up the use of alarming terminology when reporting information. In the 60s breaking news was used for an assassination or a huge global event. Now breaking news is every five minutes. The stress is high. The benefit is to the advertisers who know you’ll feel the need to continue to watch to prepare for some horrific future.

The short-term moves in the stock markets, (those less than 1 year, or even 3 years) are based more on emotions: fear, greed and hope, or guesses, than reality. Traders are constantly guessing what is around the corner. Most often they are just shooting in the dark.

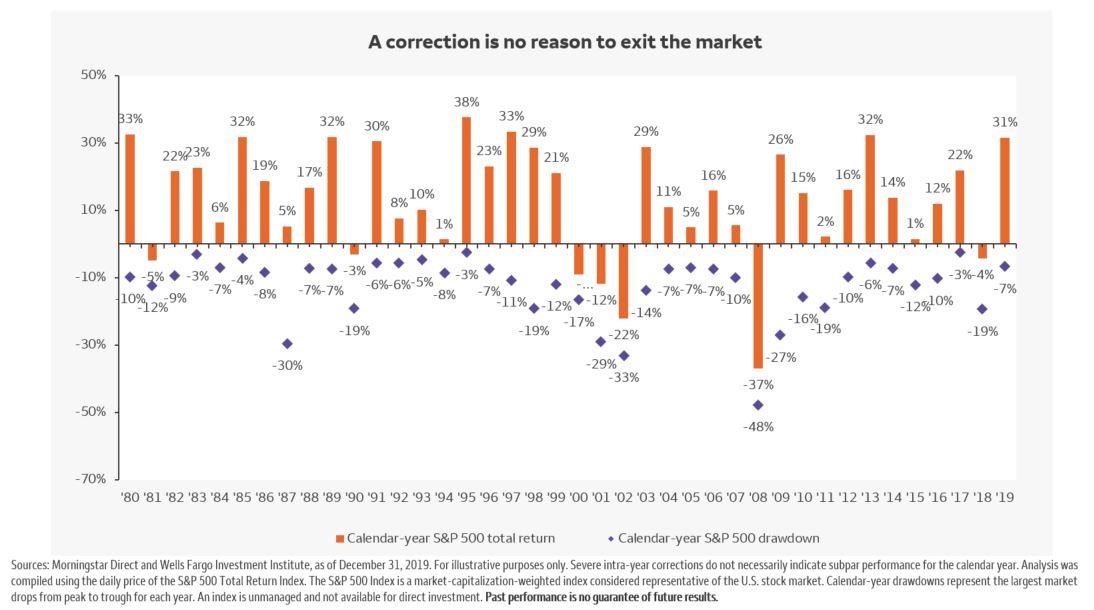

We have always cautioned to ignore these short-term expressions in the markets. When we look year over year, we see a calmer vista, a long expansion of growth. I’m including a chart that illustrates how the stock markets fall within every year, sometimes a small amount, sometimes pretty deeply, but over the years the declines are filled in, made up, risen out of.

I will tell you a little story. We stockbrokers all sat at our desks one Monday in October in 1987 completely stunned, paralyzed, because the markets were in what appeared to be a free fall like we’d never, ever seen. It was the largest percentage one day drop in history (-22.6%). That week we were dazed and afraid. But I did know the worst thing I thought I could do was to sell into this horrible market. Brokers, money managers, financial advisors, whatever you label those in this industry, do have emotions too.

One of my coworkers panicked. He sold and went to cash that week in his own 401k. We had about the same amount in our 401ks, we had been hired the same year 4 years earlier. The markets rose again, of course, and sometime during the recovery, he went back into the market. But he had lost so much, and being out of the market when it was going back up he never was able to make up for the losses he took selling at that time.

What a lesson for me as a young, green broker. I never forgot it. And I don’t want you to either.So hunker down, stay healthy and take care.

Kasey

I do hope you can read the attached graph. It shows each years close in orange and the lowest points during the year with a purple diamond. Big drops are common, but always big news in the media. To Your Prosperity and Wellbeing,

Kasey Claytor

Aaron Wade

Investment Advisor Representatives

Osprey Money Management LLC